Our Bachelor’s Degree is India’s premier Bachelor’s Degree in Actuarial Science and Quantitative Finance which is conferred by conferred by Patkar-Varde College, affiliated to the University of Mumbai, which is recognized globally and has a reputation spanning over 160 years.

This full-time 3-year Degree is based on three prominent fields – Actuarial Science, Data Science and Quantitative Finance. This degree aims at imparting knowledge through top industry experts and simultaneously moulding a student’s interpersonal skills.

Bachelors in (Actuarial Science & Quantitative Finance) offers students with the best of opportunities and a complete platform for actuarial and financial learning. It is the only Actuarial degree program in India to be accredited with the IFoA. This partnership offers students with an opportunity to earn exemptions for all core principles professional papers. (CM1, CM2, CS1, CS2, CB1, CB2).

This semester brushes up on the basics of calculus and statistical methods. It aims to introduce the students to the world of cash-flow models and time value of money which forms the basis of financial mathematics. The course aims at providing a bird's eye view of the workings of a life insurance company.

This semester delves deeper into understanding the statistical methods, financial analysis and is a refresher for algebra. It familiarizes students with the concepts of Actuarial models and provides an overview of the workings of a non-life insurance company.

In this semester, students will learn about risk modelling, mortality tables and how one can make the mortality tables fit for industrial use. It introduces one to the primary and secondary financial market.

Students will also develop an understanding of the workings of competitive markets and behaviour of consumers. Concluding the semester, the students would get a first-hand experience by solving business problems.

This semester equips one with understanding of various concepts required for model building. It acquaints them with fixed income products and introduces one to the macro side of the economy. The course expands the student's knowledge of pricing and hedging of derivatives.

Mandatory Internship:

Students have to undertake an internship before the last year begins. The Placement Cell will assist students in the internship process. The internship also helps students select their subjects for specialisation.

Choose your elective for specialization

At the beginning of the 5th semester, students are given an option to choose electives of their choice with the aim of specialization.

Elective A: Actuarial Science

Elective B: Quantitative Finance

This semester revolves around developing and honing soft skills to prepare students for the professional world. This semester incorporates an internship report which is aimed at giving the students a snapshot of the corporate arena.

Elective A

Elective B

This semester extends as per the specialisation chosen by the individual at the start of the 3rd year. Additionally, it is also aimed at providing individuals a hands-on Bloomberg terminal or similar software.

Elective A

Elective B

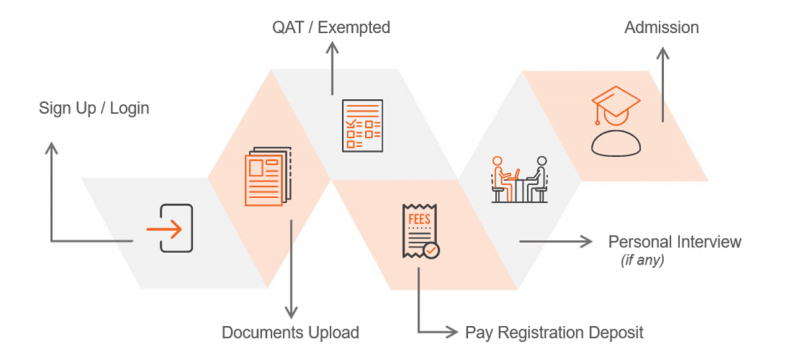

The admission process is online, thereby quick and hassle-free:

In case of any concerns, feel free to reach out to our admissions team on +91 9372777615 or drop us an email at info@iaqs.in.