Written by: Krunal Modi

Team: Padam Heda (Research)

The data sharing and Fintech sector has grown leaps and bounds over the last three decades. Right from the advent of payment gateways to cryptocurrencies, these sectors have evolved to make life simpler for consumers. In this edition of the newsletter we will talk about the next big innovation in these domains, and how it will revolutionize the world – Account Aggregators.

First things first, let us understand the basic concept behind account aggregators. Our digital footprint is everywhere. The catch is that this data is scattered and securely stored by different agencies in data centres. For instance, your insurance plan and premium payment details are with the insurance company, bank account information and transactions history with your concerned bank, investment details with the National Securities Depository Limited (NSDL), and so on. The drawback of this is that no stakeholder can access all this information from a single medium, ultimately leading to limited and inefficient use of the stored data. And in an era driven by data, it is imperative to capitalise maximally on its availability. A question might pop-up in one’ mind – so, how to gain access of all this data from a single source and without any hassle? This is where Account Aggregators (AA) come to save the day.

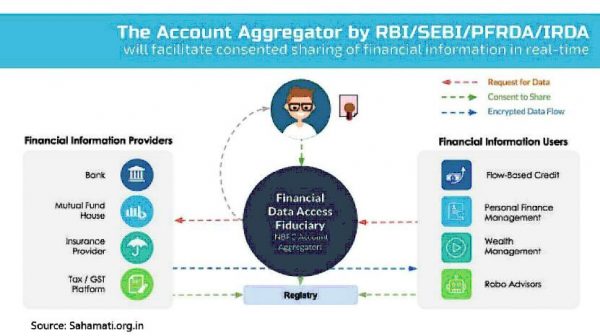

Account Aggregators are the middlemen between Financial Information Providers (FIPs) such as banks, mutual fund houses etc. and other entities that could use the information, aka Financial Information Users (FIUs), to provide various services to end consumers. Upon consumer consent, the AA fetches the data from the concerned FIP and provides it to the FIU that requires it. The AA is ‘data-blind’, meaning, as the data is encrypted and can be processed only by the intended FIU, the AA can neither store, view, nor use the data – the consumer can be rest assured of his privacy. The consent giver also has the freedom to stipulate how his data can be used – just once, or that it will expire after 7 days, for instance. One might think what is in this for FIPs, why will they share their collected data? It is a give-take thing. A financial organisation cannot access data from AAs unless it is willing to share the data that it possesses.

All financial agencies are to benefit big time because of the arrival of AAs. Let us understand the impact AAs can make on the Insurance and Finance sector:

This goes to show the manifold impacts of AAs on various domains. These were just two rudimentary examples that we looked at. Imagine its application at a much wider scale!

The Indian Government is taking significant strides in developing the Account Aggregation ecosystem in the country. RBI (the regulator of AAs) had conceptualised this way back in 2015 and also announced certain guidelines pertaining to it in the following year. Sources reveal that as of today only 5-7 (the exact number remains unknown) organisations have been approved to operate as an account aggregator. To increase awareness around AAs and promote its use, in 2019, Mr. Nandan Nilekani who is fondly referred as the ‘CTO’ of the country, introduced ‘Sahamati’ which is a pilot organisation that will work to accelerate the adoption of the framework by building awareness on the new technology, as well as supporting implementation and integration through various workshops.