~ MAITREYI PAWAR

Does your health insurance cover mental illness?

We have often come across the WHO definition of Health to be complete physical, mental, and social well-being and not merely the absence of disease and infirmity.1

Then why does health insurance not cover the expenses of mental illness? Are health insurance claims related to mental illness not as justified as a claim of physical illness?

The Mental Healthcare Act, 2017 was passed in India on April 7, 2017 and came into effect on May 29, 2018. Under Section 21(4) of this Act, “Every insurer shall make provision for medical insurance for treatment of mental illness on the same basis as is available for the treatment of physical illness.”2

Outlines of Mental Illness Claims laid by the regulator, IRDAI, in the Act

Acute depression, obsessive compulsive disorder, anxiety disorder, bipolar disorder, post-traumatic stress disorder, schizophrenia, dementia, psychotic disorder, attention deficit/hyperactivity disorder and mood disorder are the mental illnesses that are capable of mental illness claims for health insurance

Mental health insurance must have a waiting period just like any other health insurance claims – a period of 2 years. The insured claiming for mental illness must also be hospitalized for at least 24 hours, according to the regulator. Insurance companies have been instructed not to accept claims in case treatment has been done outstation or if the mental illness has arisen due to substance abuse. The regulator also allows health insurance companies to decline claims in case the insured has recurring mental illness arising due to a lack of discipline and continuity in treatment as specified by the psychiatrist.

Reality Check

Acceptance of mental illness claims in health insurance is still in a nascent stage in India.

IRDAI has made it mandatory for health insurance companies to accept claims pertaining to mental illness. Despite the regulation, health insurance companies have not yet fully adopted it. “No psychiatric illness is covered under health insurance policies,” said Indore-based psychiatrist Manish Jain in one of his interviews with ET.

According to observations 50-75% of hospitalization claims for mental illness stand rejected. Accepting claims for expensive long term therapist treatments and recovering cost of psychotropic drugs lie out of reach.

Accepting claims for expensive long-term therapist treatments and recovering the cost of psychotropic drugs is out of reach.

Problems mental illness claims face today

No reimbursement in case of mere psychiatric treatment and non-hospitalization. A sub-limit of claim amount set by the insurance companies. There are forced waiting periods during which the insured cannot make any claims.

The Need for Health Insurance to cover Mental Illness

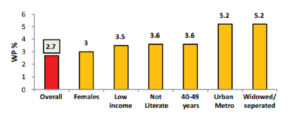

In a study, the National Mental Health Survey (NMHS) concluded that mental illness is more prevalent in individuals that belong to a lower socio-economic background, being less educated, and with low family incomes (as shown in the graph). The mental illness treatment becomes an out-of-pocket expense for them, leading to a huge economic burden on the family. This causes individuals to seek medical care on the outskirts of the city or in hospitals with cheap treatment, leading to further severity of mental illness.

The extent to which health insurance should cover mental illness

Mental illness treatments are usually long-term. Even though their hospitalization period is complete, they still have to undergo costly medications.

In my opinion, health insurance products should cover not only hospitalization costs but also cover expenditure over therapist treatments and psychotropic drugs. This would improve access to quality mental illness treatment, diversify and expand the client base of the insurance company, and improve client loyalty. As more individuals are interested in health policies that cover mental illness , the insurance companies have an opportunity to earn higher premiums. Insurance companies must also consider this as it might provide good marketing opportunities. Products covering hospitalization and therapy treatments for mental illness will stand out in the industry and force other players to adopt the same to remain competitive. Moreover, this step would actually remove any taboos that exist and push society towards considering mental and physical illness at par.

Unlike other diseases, mental illness does not always involve hospitalization. Hospitalization is only done in severe cases. A majority of illnesses involve psychiatric therapy and psychotropic drugs. These treatments are expensive and usually not considered for reimbursement. In case the insured has to undergo expensive therapies without hospitalization then, the insurer is not liable for claims. In my opinion, it is unfair towards policyholders that suffer from mild to moderate mental illness as their medical expenses are high but not eligible for claims.

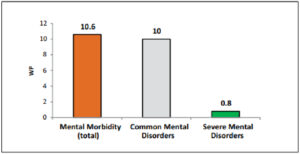

The bar chart shows statistical data proving that India has more common mental disorders than severe mental disorders.

Now this question might arise in your mind – is it easy to include mental illness cover in health insurance policies? From an insurance company’s perspective, not really. The insurance company will have to go through extensive analysis and develop models to price premiums for such products. This would require specialised actuaries who would price the product based on data from sources/countries that already cover mental illness.

Irregular therapy rates due to inflation and location of treatment is undertaken. Varying durations of treatment apart from hospitalisation subject to the prevalent illness, circumstances of the patient, and their capacity to recover – are part of a multivariate equation that lead to complex calculations of pricing models to prepare the product and payment delays when claims arise. Moreover, while catering to the mental illness data of the past decades, actuaries must keep in mind the socio-cultural, economic and technological advancements.

Though it seems to be a time-consuming process to monitor and calculate the risk involved, it is not impossible to implement. Many countries in the world have already begun its implementation. Mental illness must be included in health insurance in India, especially given the benefits of doing so.

The 29th World Mental Health Day was on 10th of October 2021. However, we still do not have adequate standards and implementation of IRDAI rules for claims of Mental Healthcare in Health Insurance. What is your take on this?

About the author:

An actuarial aspirant, Maitreyi Pawar, is a first-year student of B.Sc. Actuarial Science and Quantitative Finance. Apart from her interest in statistics, she loves to venture deep into finance, insurance and investments.

References:

- https://www.who.int/about/governance/constitution

- https://www.ncbi.nlm.nih.gov/pmc/articles/PMC6482696/